Your-Marketing-ToolkitSM

Partial List of Charts, Tables, and

Dashboards

The following is a partial list of typical

charts, tables and Dashboards that are used in Your-Marketing-Toolkit. Note

that additional charts are prepared for special and unique measures and

issues. Each of these charts represent a

family of presentations that are modified by options uniquely associated with

the each chart, by changes in the selection of groups of respondents to be

considered, and the selection of variables and products to be included.

|

|

|

|

Summary

Table: (Evaluations/Importance) Average

values of products /new concepts evaluations as well as measures of

importance. - Positioning |

Perceptual

Maps: (Evaluations/Importance) Shows

competitive position among products.

The vectors based on correlation (factors) – Positioning |

|

|

|

|

Importance Position: (Evaluations/

Importance) Shows differences

between derived and stated importance. - Positioning |

Customer Value Position: (Importance/Benefit

Value) Indicates concentration of customers and existence of major segments.

- Segmentation |

|

|

|

|

Product/Service-Supplier

Position: (Importance) Compares

product value importance with that of services. – Positioning |

Net

Promoter Index: (Evaluations)

Measures the relative willingness of

customers to recommend products. – Market Analysis |

|

|

|

|

Dynamic

Quadrant Maps:

(Evaluations/ Importance) Show the position of the attributes of

products by performance, importance and relative advantage against specific

competitor. –

Positioning, Six Sigma. |

Stated

Importance and Benefit Displays: (Importance/Conjoint) Shows the

distribution of the importance or benefit

value of two items with the identity of the respondent. – Sales Analysis |

|

|

|

|

Sources of

Information/ Key Influencers: (Demographics)

Shows the importance of the sources of information and key influencers for the

group of respondents selected. - Promotion |

Benefit/Feature

Value: (Conjoint)

The results of the perceived benefit and feature value are shown as

percentile and average values along with composite or bundle values.- Value

Analysis, Product Design |

|

|

|

|

Feature

Bundle Value Distribution: (Conjoint)

Shows the distribution of value of specific features/benefits and

combinations. Discounting of multiple

values is included as an option. Value analysis, Product Design |

Applications/Processes/Equipment

Used: (Demographics) The characteristics of

respondents’ operations are referred to as “Demographics” and are displayed

in terms of their occurrence or use level. - Positioning |

|

|

|

|

Competitive

Pricing Model: (Choice Price)

Competitive pricing is measured by the use of a

complete choice model from which interactive market price share and earnings

simulators are developed. –

Micro-Econometrics |

Demand and

Earnings Curves: (Choice

Price) Pricing profiles are generated using the competitive

pricing models indicating the demand and earnings curves along with

individual product optimum price ranges. – Micro-Econometrics |

|

|

|

|

Joint

Earnings: (Choice

Price) Where the firm has two products competing in a market

the joint earnings need to be considered in pricing. This is shown on this curve as a joint

earnings density map. – Micro-Econometrics |

Price

Elasticity: (Choice Model) Shows the relative change in demand with price across

key products. This indicates

differences in relative demand for the products at various prices. –

Micro-Econometrics |

|

|

|

|

Value

Line: (Choice Model) The “best” price for a product

reflects the position of various costs and value points. These are shown on this value line. – Value Analysis |

Strategic

Value Map: (Evaluation/Choice Price) Shows the strategic product position based

on a collective value (utility) and the price. The optimum price range is also shown to

indicate possible new directions. – Value Analysis |

|

|

|

|

Van

Westendorp Demand: (Price

Sensitivity) Concept testing focuses on the demand for a new concept against

all others at various prices. Van

Westendorp method captures extreme limits on pricing (too high and too low as

well as expectations. – Concept

Testing |

Concept

Demand & Earnings: (Concept

Pricing, Price Sensitivity) Combining both direct concept testing (given

prices) and Van Westendorp measures allow for development of a price model

based on the likelihood to purchase. – Concept Testing |

|

|

|

|

Traditional

Van Westendorp Curves: (Price

Sensitivity) Traditional Van Westendorp analysis focuses on the range of

acceptable prices as the interception of various demand curves for new

concepts. – Concept Testing |

Product

Awareness: (Demographics) Indicates the level (nature) of awareness by product

brand - Branding |

|

|

|

|

Awareness

Penetration: (Demographics) An alternative view of awareness is the degree of

“mind penetration”, that is the degree of cumulative awareness. - Branding |

Outcomes

Occurrence: (Outcomes) Outcomes are the uses and tasks for the products, The level of occurrence of the outcomes is

a key measure of importance – |

|

|

|

|

Outcomes

Positioning: (Outcomes Evaluations) Shows the three measures of

performance for outcomes: (1) stated importance, (2) incidence and (3)

difficulty of performance - |

Correlation

Map: (Evaluation) Shows the relative interrelationship among the measured

items including objectives. Colors indicate

underlying or latent variable groups. – Value Analysis |

|

|

|

|

Regression

Results: (Evaluations) Regression analysis is a strong measure of key driving

factors. Stepwise-Ridge versions

indicate major factors. – Value

Analysis |

Importance

vs. Dissatisfaction: (Evaluations) Shows the level of

dissatisfaction (performance below set-points) by product in order of

importance. – |

|

|

|

|

Pareto

Chart of Dissatisfaction: (Evaluations) Shows dissatisfaction by

product and level, displayed in order of level along with cumulative effect –

Six Sigma, |

One-by-One

Charts: (Evaluations/ Importance) Shows the relative average position of

products based on selected two variables; vector position of other variables

based on correlation - Position |

|

|

|

|

Strategic

Canvas: (Evaluation) Shows the relative value of performance features and

claims for groups of products organized in the attribute importance. – |

Operational

Beliefs & Risks: (Attitudes) Shows attributes as agreement

with statements. – Branding, SWOT Analysis |

|

|

|

|

Brand

Beliefs: (Attitudes) Shows brand perceived strengths and beliefs. Branding |

“ |

|

|

|

|

Attitudes

Evaluation: (Attitudes)

Shows the detailed attitude agreement for specific statements. – SWOT

Analysis |

Claims

Profiles: (Claims Evaluations) Shows the average claims performance by

product. Claims are simple clauses

asserting the value of a product.

Value propositions are constructed from these claims. - Branding |

|

|

|

|

Standardized

Segment Profiles: (Importance, Conjoint, Attitudes) Shows

the relative distinction among derived segments based on statistical cluster

analysis. Used to identify the nature

of the segments – Functional Segmentation |

Average

Value Segment Profiles: (Importance, Conjoint, Attitudes) Shows the actual

average values of segmentation criteria resulting from cluster analysis. Used to determine the distinction among

segments. – Functional Segmentation |

|

|

|

|

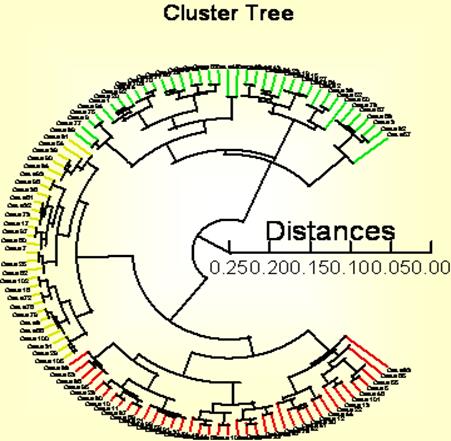

Cluster

Trees: (Importance, Conjoint, Attitudes) Shows the relative

distinction among respondents being clustered. Used to determine the effective number of

segments. – Functional Segmentation |

Current

& Future Features: (Feature Profiling) Shows the comparison

between current feature and brand selection that that preferred for the next

purchase. – Product Design |

|

|

|

|

Loyalty by

Brand: (Choice Pricing) Customer loyalty is estimated using the pricing

simulator based on the share of current customers that will repurchase the

brand. – Branding, Market Analysis |

Brands

Considered: (Brand Consideration) Shows the other brands that

will be considered beyond the current one.

This is an adjunct to the Brand Loyalty analysis showing the potential

range of action – Market Analysis |

|

|

|

|

Preferred

New Features: (Feature Profiling) Shows the preferred new product features along

with those features that are required (table stakes) and those that must not

be included - Product Design |

Product

Simulation: (Feature Profiling) The product simulator provides the expected

results of a choice among three hypothetical products based on feature

profiling. – Product Design |

|

|

|

|

Product

Simulation Results: (Feature Profiling) The results are

estimates of the shares that each hypothetical design should capture under

various |

Relative

Proportion Matrix: (Frequency Chart) The results show the

relative frequency of conditions. In

this case we view the purchase intent of customers by their age. |

|

|

|

|

|

|

|

Dynamic Positioning: (Performance

Tracking) This indicates the dynamic position of products or groups. The axes are either key variables or combinations

based on statistical compression ( CDS |

Price Estimate Smoothing: (Van

Westendorp) The estimates of target pricing from Van Westendorp exercises can

vary widely. If assume that the

expansive estimates (too expensive, too low, bargain) are functions of the

expected value then outliners can be identified and the data smoothed. This type of graph shows that analysis and

indicator of the stability of the data. For more information on developing Your-Marketing-Toolkits: Eugene B. Lieb Custom Decision Support, LLC (831) 854-2256 |

|

© Copyright Custom Decision Support, LLC (2008,

2012) |

|